DP Aircraft (#DPA) Initial Write-Up on a Highly Levered Special Situation Aug'2023

An aircraft leasing turnaround play

DP Aircraft I Limited

August 2023

Ticker: DPA.L

Price: 0.055 USD

FD shares outstanding: 239,333,333

Market Cap: 13.2mm USD

Debt: 97.0mm USD

EV: 110.2mm

Overview

DP Aircraft I Limited is a Guernsey-based holding company that leases aircraft through its subsidiaries. As a closed-end investment fund it is listed in the London Main Market Specialist Fund Segment, which targets institutional and professional investors.

The company was incorporated in 2013 and issued 113,000,000 shares at USD 1.00. Subsequently it raised ca. 155,000,000 USD debt and bought two Boeing 787-8 Dreamliner which were then leased for 12 years to Norwegian Air Shuttle ASA. Lease payments from the lessee were intended to contribute to administration costs, finance costs, loan amortization and a dividend payment to shareholders.

In 2015 the playbook was repeated with a further issuance of 96,333,333 shares at USD 1.0589. With an additional ca. 155,000,000 USD debt two Boeing 787-8 Dreamliner were bought and then leased for 12 years to Thai Airways.

Following Covid, Norwegian Air Shuttle ended lease payments to the company, leading to the company’s banker declaring an event of default, effectively repossessing the aircraft and selling it off, wiping out all equity. However, the aircraft were held in subsidiaries so there was no recourse by the bank to the holding company and the Thai aircraft remained unaffected.

Thai Airways went into bankruptcy protection in May 2020 and as of August 2023 works on a restructuring which shows early success. It is key to my thesis that with the Thai government owning 40%+ of the business and the country’s heavy reliance on tourism it is a non-rational player which will continue to support the airline. The two Thai aircraft remain the only assets of the company, which are now operating under adjusted lease contracts.

At the peak of the panic the share price was battered down to USD 0.02, which has now recovered to USD 0.055. This is because forward visibility has improved, with the lease contracts for the two Thai aircraft expiring in 2026. The loan terms were amended to match the contracted lease payments by Thai Airways so that 93% of the payments are now used for loan amortization and interest payments with the remaining 7% contributing to ongoing running costs of the company. It is my understanding that at the end of the leases in 2026 the two aircraft will be sold where the proceeds will be used for repaying the residual debt in a balloon payment and with the remaining cash distributed to shareholders.

Ultimately, the value of the shares will be determined by the resale value of the two aircraft in 2026 less debt and how much earnings will amount until then.

NAV – Aircraft valuation

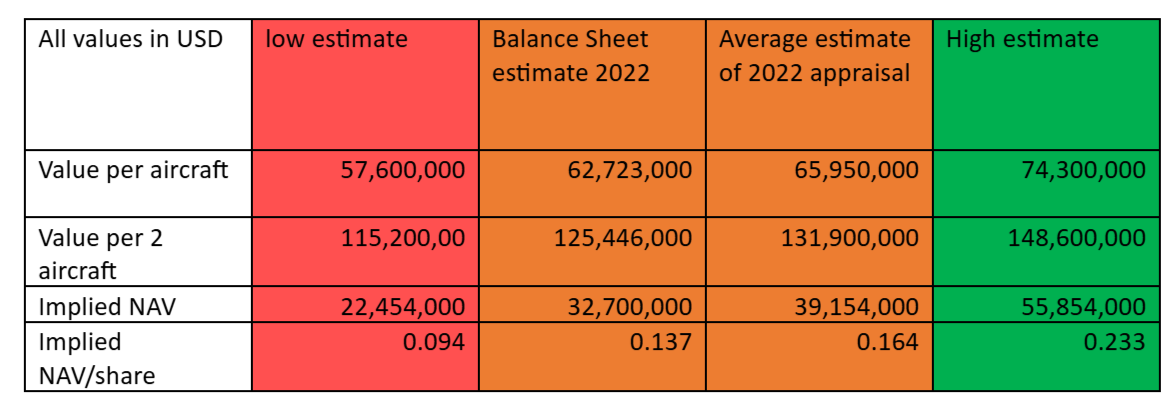

It is key to understand how the company assesses aircraft value. It is industry practice that two-three independent appraisers are hired to give a range of their estimates of resale value less cost to sell. The average will find its way into the balance sheet. In 2020 and 2021 the company did not provide the ranges, only the average. In the 2022 report the ranges have been disclosed, with the following result:

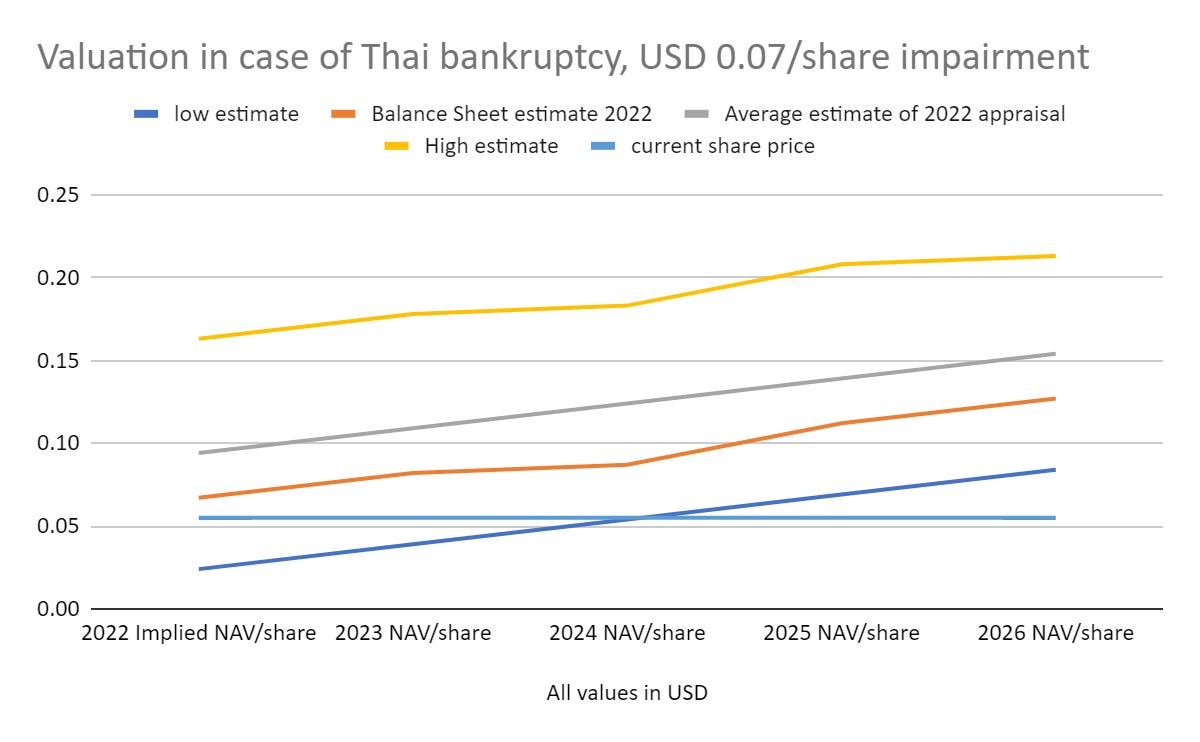

With the share trading at USD 0.055 and the realization of value in 2026, the upside seems attractive.

However, I don’t want to simply rely on the appraiser’s view and my research yielded the following points:

Typically, airlines and lease corporations carry aircraft at a lower than fair value, building up hidden reserves which are released into earnings upon sale. Air Lease Corporation and Aercap typically realize 6-8% gain upon sale.

Resale value relies on the demand/supply at the end of the lease and varies heavily for different aircraft type. One of the most important criteria for airlines today with higher fuel prices and government´s net-zero ambitions is efficiency. This can be observed after Covid in the phasing-out of previous-generation aircraft and scaling up of the newer, more efficient aircraft like the 787s owned by the company.

A further determinant of the resale value is the condition: After 12 years a major overhaul of the aircraft is required, after which the aircraft is improved from half-life condition to full-life condition. Thai Airways is contracted to return the aircraft in full-life condition, thus bearing the maintenance cost, but also implying some credit risk. If Thai Airways were to return the aircraft in half-life condition, an impairment of USD 30,000,000 would have to be booked, offset by maintenance prepayments of USD 15,000,000, leading to a loss of equity worth USD 15,000,000 or USD 0.063 / share.

Supply chain problems for the aircraft manufacturer have limited the delivery of new aircraft which remain at depressed levels. With international travel recovering, a shortage of aircraft can be observed, which supports the value of existing aircraft.

Inflation increases the prices of new aircraft, thus again supporting the value of existing aircraft.

This research strengthened my conviction that the valuation in the balance sheet can actually be realized in cash.

Debt analysis

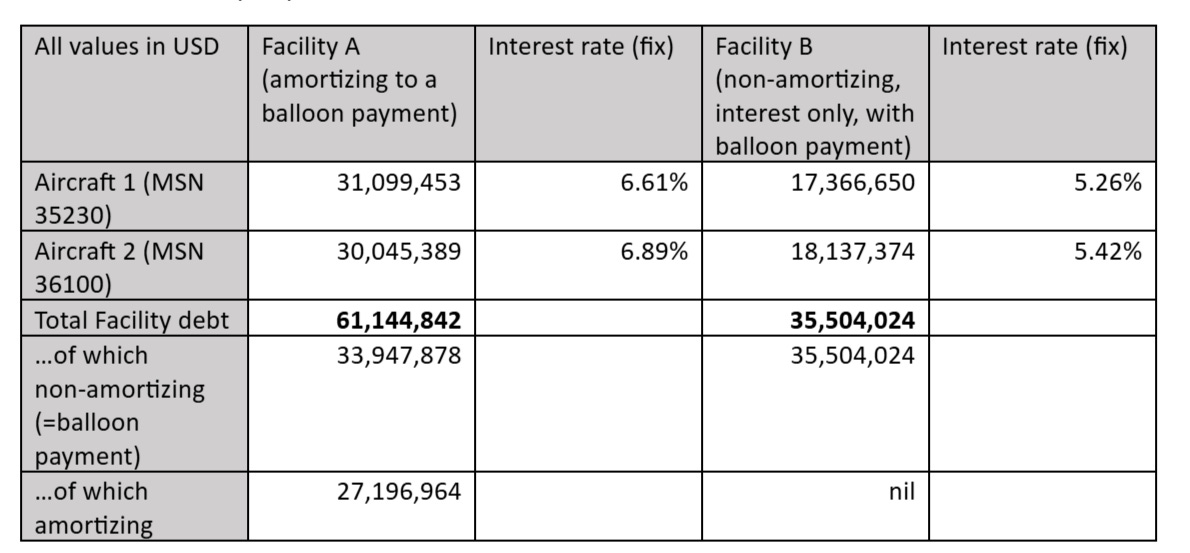

Total debt is structured as follows, indicating financial stability until the expiry of the lease. Total debt outstanding is made up of Facility A, USD 61,144,842, and Facility B, USD 35,504,024, combining to a total of USD 96,648,866.

Earnings until end of contract

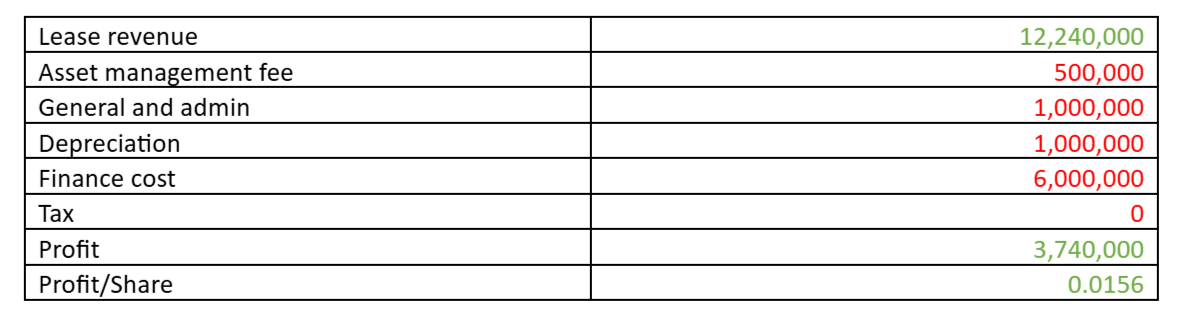

The NAV outlined above will change for the results of FY23, FY24, FY25 and FY26. I will therefore estimate these (all values in USD):

Data for the above table come from the Annual Report 2022. Finance cost is a rough estimate from total debt (ca. USD 100,000,000) and average interest rate (6,0%). Loan amortization will reduce loan outstanding and thus finance cost in later years, so these estimates are on the conservative side. I may point out that all cash generated after cash expenses will be used to pay down the debt.

My analysis shows that for the four years NAV/share will grow by USD 0.015/year or USD 0.06/4 years.

Valuation

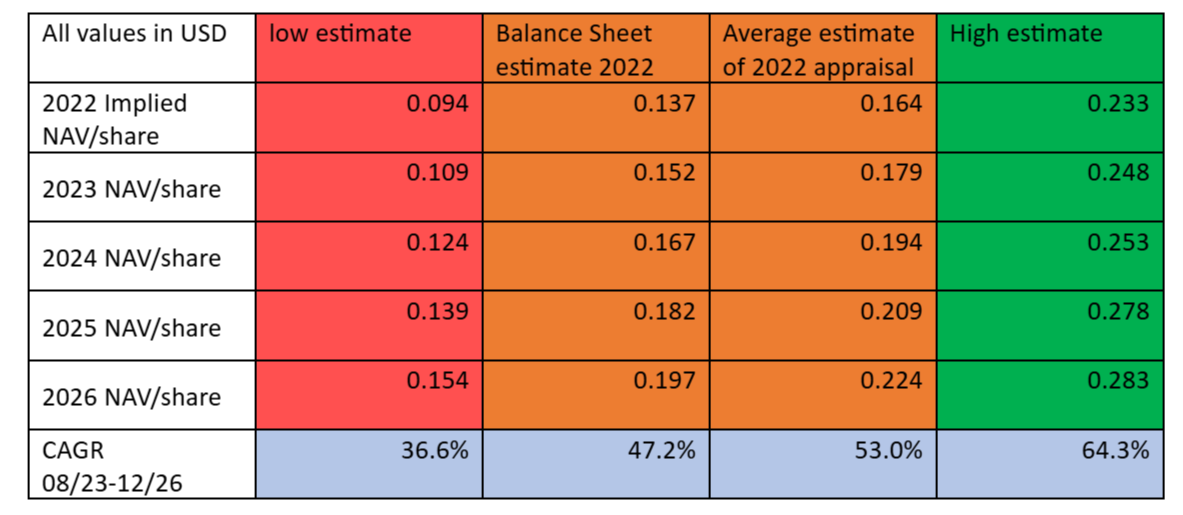

I will build my valuation on a combination of the above assessed NAV/share and the USD 0.015 earnings/share for the years ending 2023, 2024, 2025, 2026.

In the event of Thai Airways’ default, as set out above, an impairment for overhaul costs of USD 15,000,000 or USD 0.063 / share would have to be booked. If we roughly allow for an additional 10% transaction cost, the impairment would lead to USD 0.07 in total, which seems bearable, given the current share price.

Risks

The main risk is a failed restructuring of Thai Airways. This scenario is somewhat alleviated by the fact that Thai Airways constitutes strategic value as the national flag carrier for the country’s tourism industry. The government therefore holds a +40% stake in the company. The restructuring has led to profitable quarters recently, yet a large debt pile remains outstanding. It is planned to agree on a debt-to-equity swap and an equity raise.

The resale market of aircraft can break in a matter of days, as evidenced by 9/11 or the Covid pandemic. However, it is common practice that aircraft can be stored in a dry climate for my rough estimate of USD 1,000,000/year, mainly maintenance cost. It can then be sold at later times, when the market somewhat recovers.

While the 787 Dreamliner is a success story and the aircraft remain the newest generation and fuel-efficient aircraft, it is to be noted that out of the family (787-8, 787-9, 787-10) the 787-9 is the most popular and widely used aircraft. The larger size of the 9 allows greater efficiency compared to the 8, which nonetheless has its place in mid-haul travel.

Technically Thai Airways has an option to continue to lease the aircraft after 2026 for a further 3-year period, but the company has a right to cancel the lease. It is stated throughout the annual report 2022 that the leases are expected to be terminated in 2026.

A further technical risk lies in the unlikely event that directors would like to continue the company and not return the cash to shareholders, as they could benefit from continued fees. However, I believe shareholders will not allow this to happen.

Attachment

Excellent article - and from the returns generated since publication, a good position! Congrats

Welcome to Substack Cyrill! Thanks for sharing this great analysis on an overlooked name.

I'm really looking forward to reading some more of your unique work on micro-caps with hidden value!