Northern Bear PLC: Structural Improvement Hidden in Plain Sight

A 3x EBIT multiple for a business that just improved profitability by 72%? The market thinks it's weather. I think it's management.

Investment Snapshot

Northern Bear PLC (LON: NTBR)

October 2025

Price: £1.10

Fully Diluted Shares: 13,792,000

Market Cap: £15.2mm

Net Cash: £2.5mm

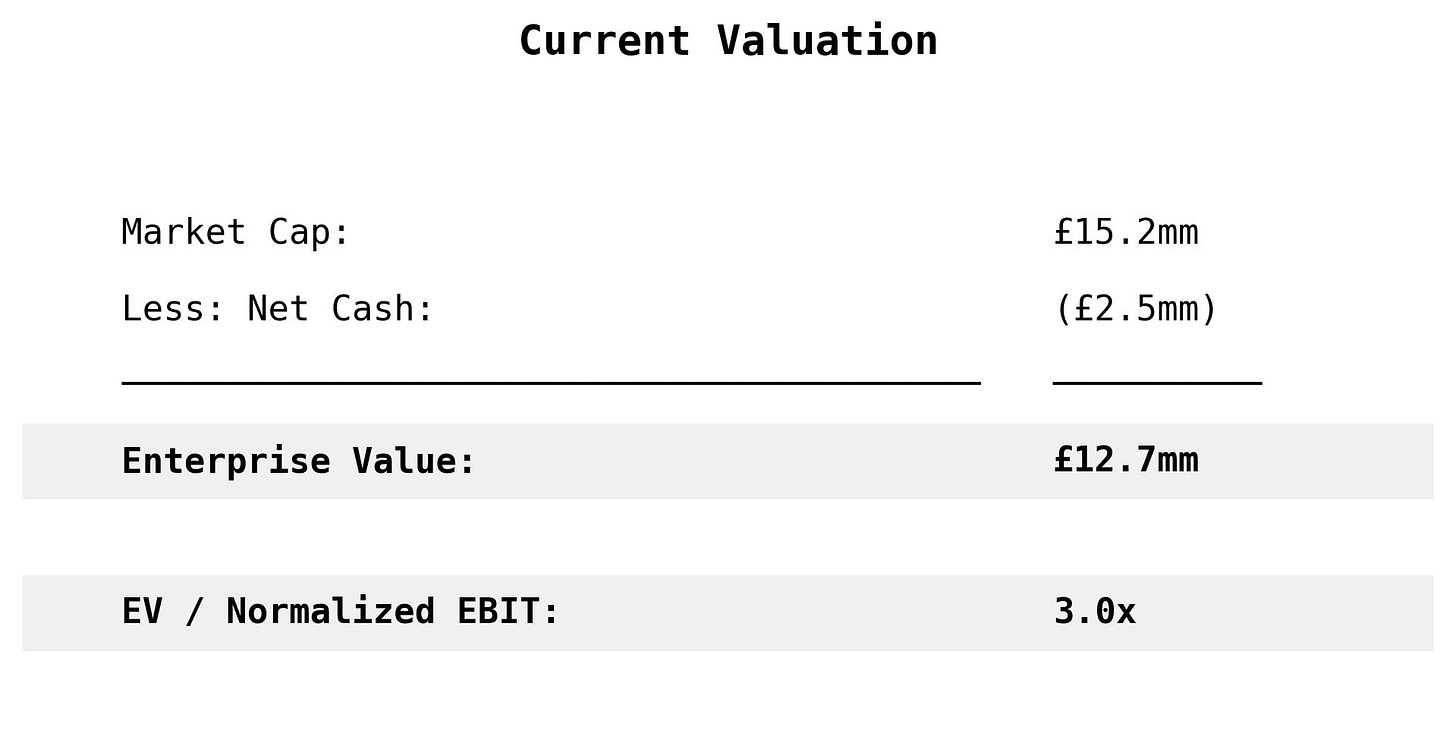

Enterprise Value: £12.7mm

EV / Normalized EBIT: 3.0x

Thesis

Northern Bear trades at 3.0x normalized EBIT despite structural improvements that warrant re-rating to 6x, more in line with the Construction Service sector average. New CEO John Davies has repositioned the business toward higher-margin compliance work, eliminated loss-making operations, and is likely to divest the capital-intensive Alcor materials handling subsidiary. The market views FY25’s strong results as weather-driven and temporary—I believe they represent a sustainable step-change in profitability.

Expected Return: 80-125% over 18-24 months as the market recognizes the improvement and a potential Alcor sale crystallizes value.

What the Market is Missing

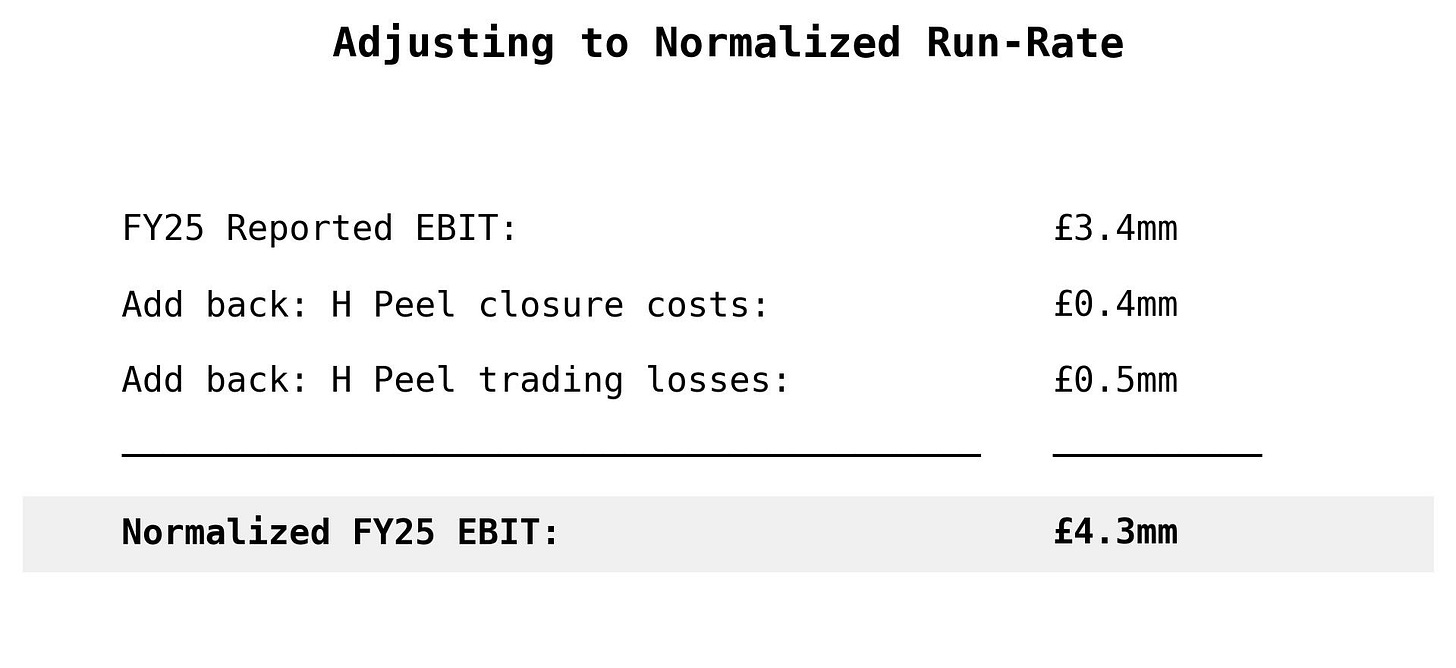

FY25 reported EBIT of £3.4mm significantly understates the business’s normalized earnings power. Management took conservative provisions related to closing the underperforming H Peel subsidiary, which obscure the underlying performance:

This £4.3mm normalized figure represents a 72% increase versus the historical £2.5mm run rate.

Management attributed some of the improvement to favorable weather conditions (a dry winter), but this explanation doesn’t hold water when you examine what’s actually changed operationally. Three structural improvements explain the bulk of the profit increase:

Fire Protection: The Mix Shift to Compliance Work

This is the crown jewel of the improvement story. Management has systematically reallocated labor away from low-margin subcontracting work toward higher-margin regulatory compliance projects.

The economics are compelling: compliance work driven by regulatory requirements commands better pricing and more predictable demand than competitive bid work. The company is also investing to expand beyond its North-East base toward national delivery, capitalizing on multi-year regulatory tailwinds in fire safety.

This isn’t a quarter-to-quarter improvement—this is a fundamental repositioning of the business model.

Building Services: Better Contract Selection Paying Off

The building services segment was historically plagued by poor contract selection, accepting low-margin work just to keep people busy. Over the past few years, this has been methodically improved.

What’s notable here: this turnaround happened under John Davies’ watch when he ran the division, before becoming Group CEO. He knows this business intimately and has demonstrated he can fix broken operations.

H Peel Closure: Cutting Losses

Davies made the tough call to close the underperforming H Peel subsidiary, eliminating a £0.5mm drag and freeing up management attention.

This decision signals something important: management is willing to sacrifice short-term revenue for long-term profitability. That’s the kind of resource allocation discipline that compounds over time.

Roofing: Stable Base Business

The roofing segment, which represents 42% of group sales, continues to perform consistently but hasn’t been a driver of the margin improvement story. This is a mature, predictable business that generates steady cash flow and underwrites the fixed cost base. While it’s not where the excitement lies, its stability is valuable—it provides the foundation that allows management to take calculated risks on repositioning the higher-margin segments.

My View: The £4.3mm run-rate is sustainable and likely conservative. Management has guided to repeating this performance in FY26, which supports the structural nature of the improvement. Yet the market continues to apply a 3x multiple, suggesting investors view FY25 as an outlier rather than the new baseline.

Valuation: Significant Upside to Fair Value

Let’s start with where we are today:

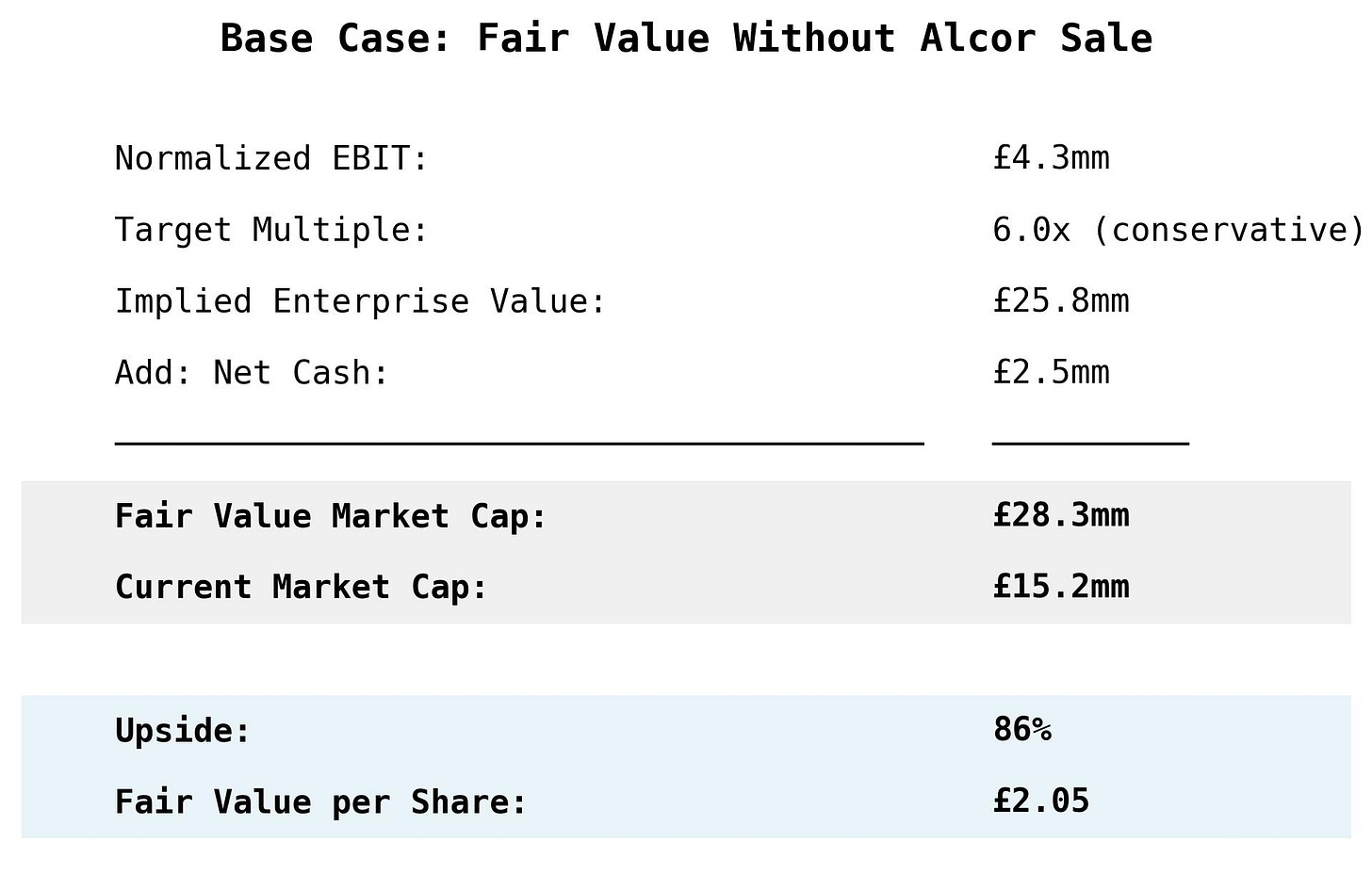

Given that the Construction Services sector average P/E is 13.6, it is not inconceivable that the company can command a 6.0x EBIT multiple, translating into a conservative P/E multiple of ~8.0x.

That’s 86% upside just from multiple expansion as the market recognizes the structural improvement. No heroic assumptions required.

Upside Case: Alcor Divestiture

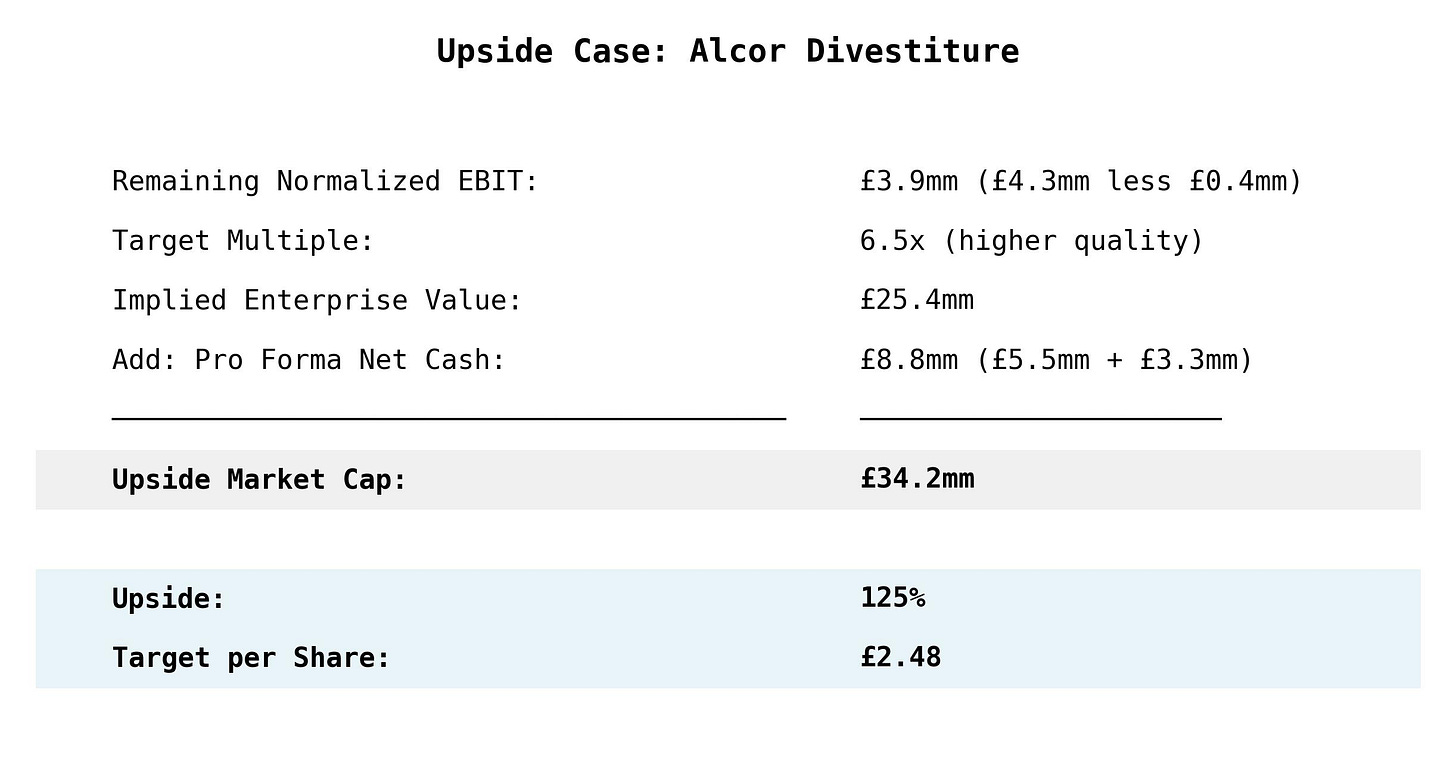

But there’s more upside if management executes on what I believe is their likely plan: divesting the Alcor materials handling business.

The Alcor Situation:

Alcor has been a longtime investor concern. It’s a capital-intensive materials handling business that generates £0.36mm EBIT on £3.3mm of net assets—an 11% return on equity.

Why I Think a Sale is Likely:

Based on recent annual reports, investor presentations, and my conversation with management, I estimate a 70%+ probability of divestiture within the next 12 months.

If management divests Alcor at book value (£3.3mm):

Why 6.5x is Still Conservative:

Post-Alcor, the remaining business would be:

Lower capital intensity

More predictable revenue streams (compliance/regulatory focus)

Led by management with demonstrated capital allocation skill

Sitting on £8.8mm net cash (providing both downside protection and M&A optionality)

The Future: Growth Optionality

Beyond the re-rating opportunity, there are two additional sources of upside:

Organic Growth

Management continues to invest around two themes:

Enhancing the service offering (moving up the value chain)

Focusing on regulatory drivers (building safety, compliance requirements)

I expect modest organic growth of 3-5% annually from these investments, though I’m not underwriting aggressive growth into my base case.

M&A Opportunity

Here’s where it gets interesting. The business will generate significant cash: £5.5mm forecast net cash for FY26, potentially £8.8mm post-Alcor sale.

Generally, I’m skeptical of acquisition strategies—most destroy value. But Davies has created trust through his operational track record and demonstrated capital discipline (closing H Peel, likely divesting Alcor). Management has articulated thoughtful acquisition criteria focused on:

Cultural fit and people risk assessment

Bolt-on acquisitions in existing markets

Businesses with regulatory/compliance tailwinds

While execution risk remains, I see a reasonable probability of a value-creating acquisition that could provide additional upside beyond my base case.

The Risks

Despite recent successes the main risk lies in capital allocation. Having amassed a pile of cash, the dividend remains small as cash is invested internally and presumably kept within the business to pay for an acquisition. While I like their stated acquisition criteria and find them thoughtful around potential people risk, there remains a risk of buying a bad business and wasting the cash.

From the outside it remains hard to evaluate the quality of the building services contracts. It is unclear whether profitable contracts will be available in the future and margins could contract.

Organic growth remains reliant on skilled staff, which reportedly is hard to find.

Summary

Northern Bear represents the kind of opportunity that makes small-cap investing worthwhile: a quality business undergoing structural improvement, led by competent management, trading at a substantial discount to fair value because the market hasn’t recognized what’s changed.

The setup is compelling:

72% improvement in normalized earnings vs. historical run-rate

Trading at 3x EBIT

CEO demonstrating capital allocation skill

Probable catalyst (Alcor divestiture) within 12 months

This asymmetry is attractive: 80-125% upside versus minimal downside, with net cash providing a floor under the valuation.

Disclosure: I am long Northern Bear PLC (LON: NTBR). This is not investment advice. I may buy or sell shares at any time without notice. Do your own research.

Have thoughts on Northern Bear or see something I’m missing? Drop a comment below—I’m happy to discuss the investment in more detail.

The analysis is original - the delivery polished by AI.

The mix shift in Fire Protection is what really stands out here. Moving from low-margin subcontracting to compliance-driven work is exactly the kind of strategic repositioning that often flies under the radar in small caps. The regulatory tailwinds in fire safety post-Grenfell should provide multi-year demand visibility, which typically commands a premium multiple. Your point about Davies' operational track record is well taken—his willingness to close H Peel and potentially divest Alcor shows real capital discipline. That said, I share some of Winter's concern about M&A. The 3x EBIT entry point provides margin of safety, but I'd prefer to see buybacks given the valuation disconnect rather than acquisitions that carry execution risk. Still, the asymetry here is compelling. Quality analysis, thanks for sharing.

New CFO - appointed in May will leave the board with immediate effect. Can mean nothing but I don't like such news.